:max_bytes(150000):strip_icc()/Term-Definitions_corporategovernance-dba10e3df300439597427b2518b96b93.png)

Corporate governance

So, you’re running a business, or maybe you’re just interested in how the big companies operate. Either way, you’ve probably heard the term “corporate governance” floating around. It sounds important, and it is. But what exactly does it mean? In simple terms, corporate governance is all about the rules, processes, and systems that direct and control a company. It’s about making sure businesses are run ethically, efficiently, and responsibly. Think of it as the framework that keeps things on track and prevents chaos (or worse, illegal activity).

Why is this important? Well, good corporate governance builds trust with investors, customers, and the public. It helps companies attract investment, perform better, and avoid scandals that can damage their reputation and bottom line. On the flip side, poor corporate governance can lead to all sorts of problems, from financial mismanagement to ethical breaches and even outright fraud.

Let’s dive into some of the key elements of corporate governance:

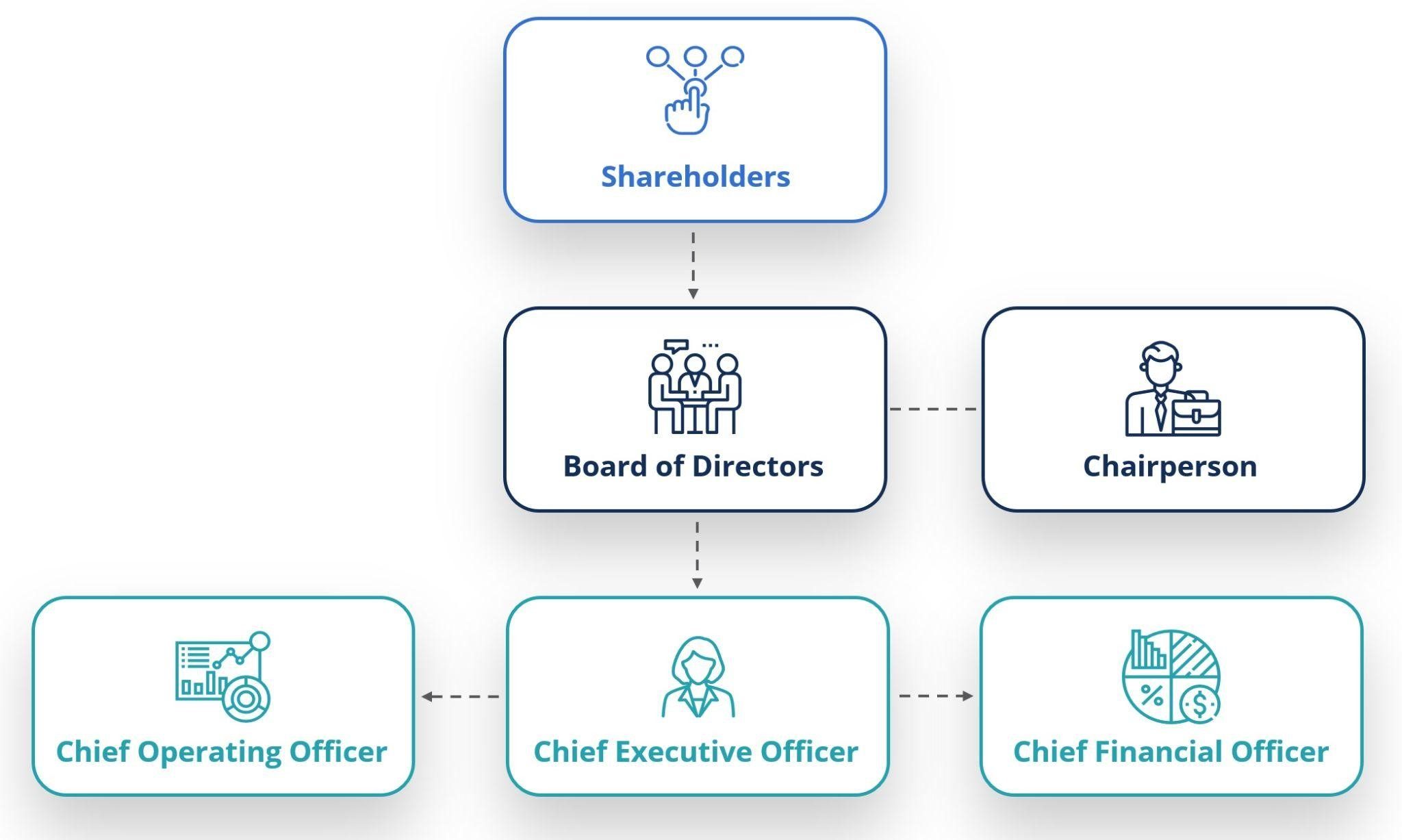

Board of Directors: The Captains of the Ship

The board of directors is like the captain of the ship. They’re elected by the shareholders (the owners of the company) and are responsible for overseeing the company’s overall strategy and performance. They appoint the senior management team, monitor their performance, and make sure the company is acting in the best interests of its shareholders. A good board should have a mix of skills and experience, and it should be independent enough to challenge management when necessary.

Management: Running the Day-to-Day Operations

While the board sets the overall direction, the management team is responsible for running the day-to-day operations of the company. This includes things like developing and implementing business plans, managing finances, and hiring and managing employees. Effective management is crucial for a company’s success, and they are accountable to the board for their performance.

Shareholder Rights: Giving Owners a Voice

Shareholders are the owners of the company, and they have certain rights, including the right to vote on important matters like the election of directors and major corporate transactions. Good corporate governance ensures that shareholder rights are protected and that they have a say in how the company is run. Regular communication and transparency are key here.

Transparency and Disclosure: Keeping Things Open and Honest

Transparency and disclosure are all about keeping things open and honest. Companies should be transparent about their financial performance, their business practices, and any potential risks they face. This helps investors make informed decisions and builds trust with stakeholders. Regular financial reporting, clear communication with investors, and open access to information are crucial aspects of transparency.

Risk Management: Identifying and Mitigating Potential Problems

Every business faces risks, from market fluctuations to regulatory changes. Effective corporate governance includes having systems in place to identify, assess, and manage these risks. This helps companies avoid potential problems or minimize their impact. A robust risk management framework is essential for long-term sustainability.

Internal Controls: Safeguarding Assets and Preventing Fraud

Internal controls are the policies and procedures that a company puts in place to safeguard its assets and prevent fraud. This includes things like checks and balances on financial transactions, regular audits, and clear lines of authority. Strong internal controls are essential for maintaining financial integrity and preventing losses.

Ethics and Compliance: Doing the Right Thing

Ethics and compliance are about doing the right thing, even when no one is watching. Companies should have a strong code of ethics that guides their behavior and ensures they comply with all applicable laws and regulations. This includes things like avoiding conflicts of interest, treating employees fairly, and acting responsibly towards the environment. A culture of ethical behavior is essential for building trust and maintaining a positive reputation.

Accountability: Taking Responsibility for Actions

Accountability is about taking responsibility for one’s actions. In a corporate context, this means that directors and managers are accountable to shareholders for their decisions and performance. Clear lines of accountability help ensure that everyone is doing their job and that problems are addressed promptly.

The Role of Regulation: Setting the Ground Rules

While companies have a responsibility to govern themselves effectively, governments also play a role in setting the ground rules. Regulations are put in place to protect investors, prevent fraud, and ensure that companies are acting in the public interest. These regulations can vary from country to country, but they generally cover areas like financial reporting, corporate governance practices, and shareholder rights.

Benefits of Good Corporate Governance: Why It Matters

Implementing good corporate governance practices brings several benefits to a company:

Enhanced Reputation and Trust

A company with a strong track record of good governance builds trust with investors, customers, employees, and the wider community. This enhanced reputation can translate into increased business opportunities and stronger stakeholder relationships.

Improved Access to Capital

Investors are more likely to invest in companies with strong corporate governance practices. This can lead to improved access to capital and lower borrowing costs.

Better Financial Performance

Studies have shown a link between good corporate governance and improved financial performance. Companies that are well-governed tend to be more efficient, more profitable, and less prone to financial distress.

Reduced Risk of Scandals and Legal Issues

Strong corporate governance practices help companies avoid scandals, legal issues, and reputational damage. This can save companies significant time, money, and resources.

Increased Employee Morale and Productivity

A culture of ethical behavior and accountability can boost employee morale and productivity. Employees are more likely to be engaged and motivated when they feel that the company is being run fairly and ethically.

Long-Term Sustainability

Good corporate governance is essential for long-term sustainability. It helps companies navigate challenges, adapt to changing market conditions, and create long-term value for shareholders.

In conclusion, corporate governance is not just a buzzword; it’s a crucial framework for running successful and responsible businesses. It’s about setting clear rules, promoting transparency, ensuring accountability, and fostering a culture of ethical behavior. By implementing strong corporate governance practices, companies can build trust with stakeholders, improve financial performance, reduce risks, and achieve long-term sustainability. It’s an investment that pays off in the long run, contributing to a healthier and more trustworthy business environment.